Neat Tips About How To Avoid Capital Gains Tax

The main way to reduce your capital gains taxes is by making sure you calculate in all of the reductions that the irs allows to your overall profits.

How to avoid capital gains tax. Note that this does not mean you have to own the. You can also offset capital. The same is true for stocks.

That’s “may have to” not “will have to,” because there are several strategies you can use to avoid capital gains tax or at least reduce what you’ll owe. If you hold a number of different assets, you may be able to offset some of your gains with any applicable losses, allowing you to avoid a portion of your capital gains taxes. How to avoid capital gains tax on a home sale.

To get around the capital gains tax, you need to live in your primary residence at least two of the five years before you sell it. Putting your earnings in a tax sheltered account can allow you to avoid capital gains taxes altogether for that particular money for a given period of time. With this strategy, you can sell off an asset that has lost value and realize a loss.

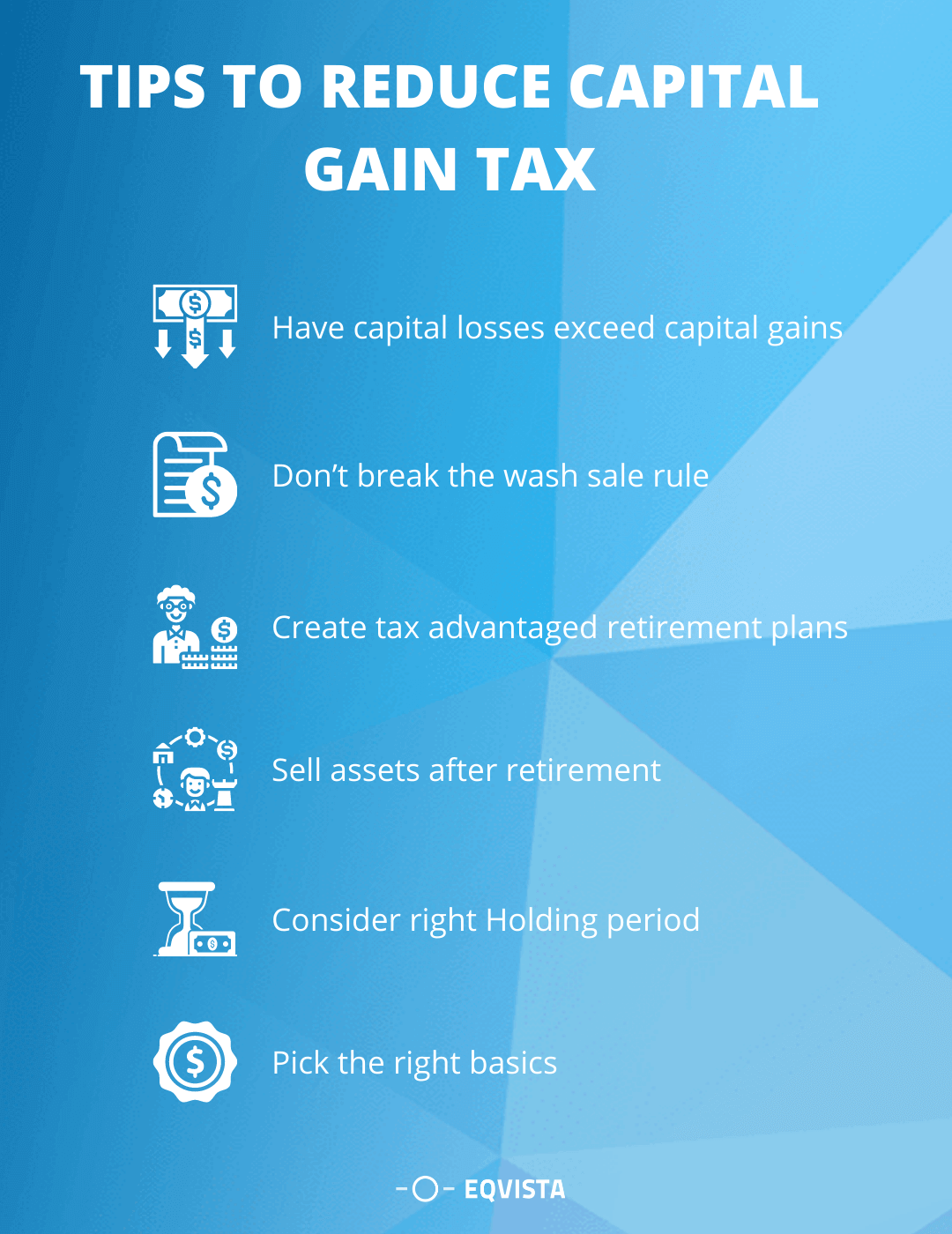

However, there are some legal methods to minimize those taxes, such as: After that, the capital gains. 9 ways to avoid capital gains taxes on stocks.

Hold investments for a year or more. Business owners can defer capital gains tax through december 31, 2026, by reinvesting capital gains from the sale of a business into an opportunity zone. The same is true for stocks.

Live in the house for at least two years. You can avoid paying taxes on the capital gains from appreciated land if you donate the land to charity. Use a roth ira or roth 401 (k).

![Video] Section 1031 Exchange Basics: How To Avoid Capital Gains Tax](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/Section-1031-Exchange-Basics-Video-1024x536.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)